Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may business guides drop. The cost of debt and a company’s ability to service it can vary with market conditions. As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances. In this ratio, operating leases are capitalized and equity includes both common and preferred shares.

Debt to Equity Ratio Explained

The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt. It is calculated by dividing the total liabilities by the shareholder equity of the company. This ratio is commonly used by investors, financial analysts, and creditors to measure a company’s risk, financial stability, and efficiency of its financial structure. A higher ratio indicates that a company relies more on debt to finance its operations, which can be riskier, especially during economic downturns.

It Can Misguide Investors

The combination of fractional-reserve banking and Federal Deposit Insurance Corp. (FDIC) protection has produced a banking environment with limited lending risks. A debt ratio of 0.2 shows that it is very unlikely for Company C to become bankrupt, even if the economy were to crush. In this guide, we’ll explain everything you need to know about the D/E ratio to help you make better financial decisions. Get instant access to video lessons taught by experienced investment bankers.

Step 1: Identify Total Debt

They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt. Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity.

Salary & Income Tax Calculators

Analysts and investors compare the current assets of a company to its current liabilities. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times. The reason for this is there are still loans that need to be paid while also not having enough to meet its obligations. The debt-to-equity (D/E) ratio can help investors identify highly leveraged companies that may pose risks during business downturns. Investors can compare a company’s D/E ratio with the average for its industry and those of competitors to gain a sense of a company’s reliance on debt. Changes in long-term debt and assets tend to affect the D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets.

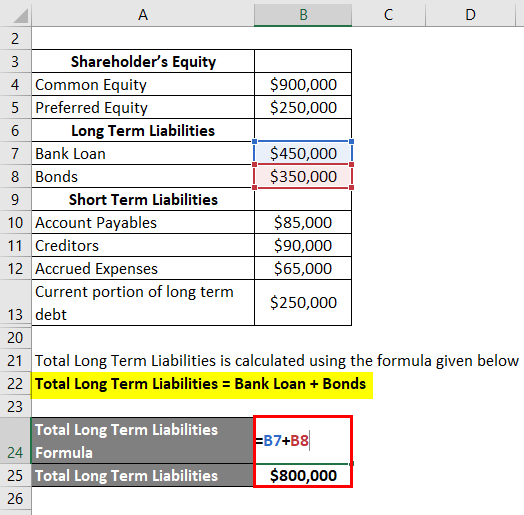

Debt to Equity Ratio Formula & Example

- Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

- Each industry has its own standard or normal level of shareholders’ equity to assets.

- Including preferred stock in total debt will increase the D/E ratio and make a company look riskier.

Higher D/E ratios can also tend to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. As a rule, short-term debt tends to be cheaper than long-term debt and is less sensitive to shifts in interest rates, meaning that the second company’s interest expense and cost of capital are likely higher.

The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity. A business that ignores debt financing entirely may be neglecting important growth opportunities. The benefit of debt capital is that it allows businesses to leverage a small amount of money into a much larger sum and repay it over time. This allows businesses to fund expansion projects more quickly than might otherwise be possible, theoretically increasing profits at an accelerated rate. A steadily rising D/E ratio may make it harder for a company to obtain financing in the future. The growing reliance on debt could eventually lead to difficulties in servicing the company’s current loan obligations.

Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. Debt financing happens when a company raises money to finance growth and expansion through selling debt instruments to individuals or institutional investors to fund its working capital or capital expenditures. A good D/E ratio also varies across industries since some companies require more debt to finance their operations than others. If a company cannot pay the interest and principal on its debts, whether as loans to a bank or in the form of bonds, it can lead to a credit event.

As an individual investor you may choose to take an active or passive approach to investing and building a nest egg. The approach investors choose may depend on their goals and personal preferences. The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies. If earnings don’t outpace the debt’s cost, then shareholders may lose and stock prices may fall.